omaha nebraska vehicle sales tax

Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The Official Nebraska Department of Motor Vehicles DMV Government Website.

Used Pre Owned Auto Specials Infiniti Of Omaha

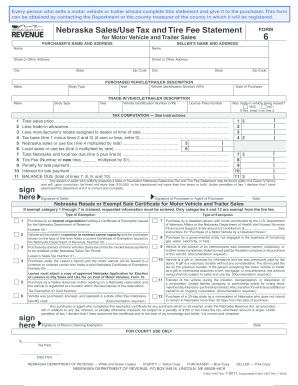

Sales and Use Tax Regulation 1-02202 through 1-02204.

. 55 is the smallest possible tax rate abie nebraska 6 65 7 725 75 are all the other possible sales tax rates of nebraska. 2021 Sales Tax 55. The Nebraska state sales and use tax rate is 55.

- 2000 Total Due. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023. The Nebraska sales tax rate is currently.

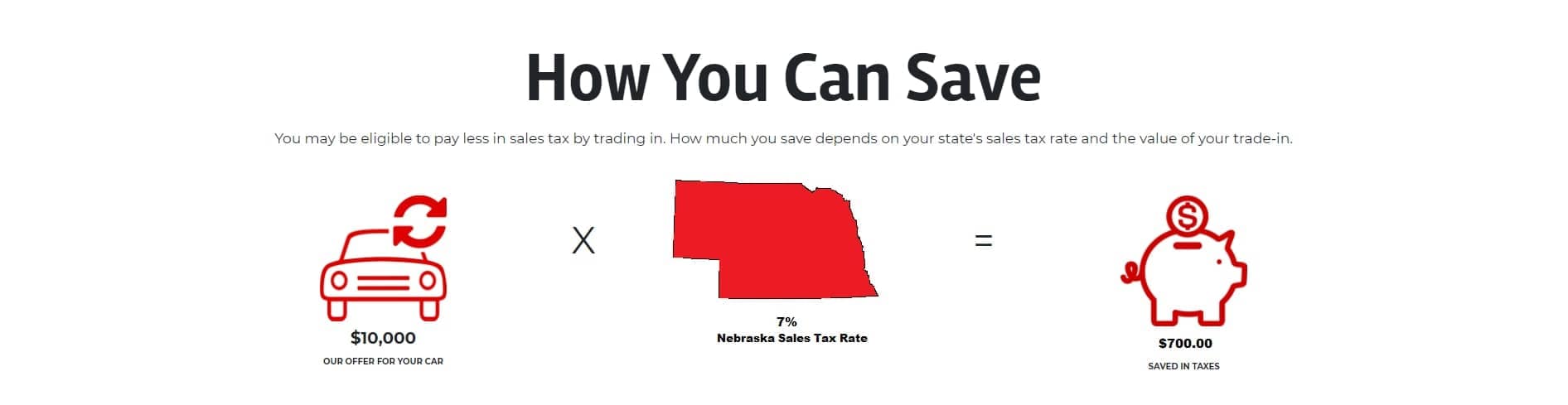

2021 Sales Tax 55. Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local.

2020 Net Taxable Sales. Download all Nebraska sales tax rates by zip code. Please refer to Certificate of Title for further information regarding the title application process and Vehicle Registrations for.

49 rows Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards. Purchase of a 30-day plate by a. State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee.

The current total local sales tax rate in Omaha NE is 7000. This includes the rates on the state county city and special levels. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

2020 Net Taxable Sales. Omaha has parts of it located within Douglas County. If you are registering a motorboat.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. The County Treasurer then issues a title to the new owner. The nebraska sales tax rate is currently.

2020 Sales Tax 55. Please note that the total amount due from the customer consists only of the tax calculated and collected by the. Driver and Vehicle Records.

This is the total of state county and city sales tax rates. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. Registration Fees and Taxes.

2020 Sales Tax 55. Douglas County Nebraska Department of Motor Vehicles DMV. The Nebraska state sales and use tax rate is 55 055.

Current Local Sales and Use Tax. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. The December 2020 total.

The minimum combined 2022 sales tax rate for Omaha Nebraska is. In addition local sales and use taxes can be set at 05 1 15 175 or 2 as adopted by city or county governments. The average cumulative sales tax rate in Omaha Nebraska is 686.

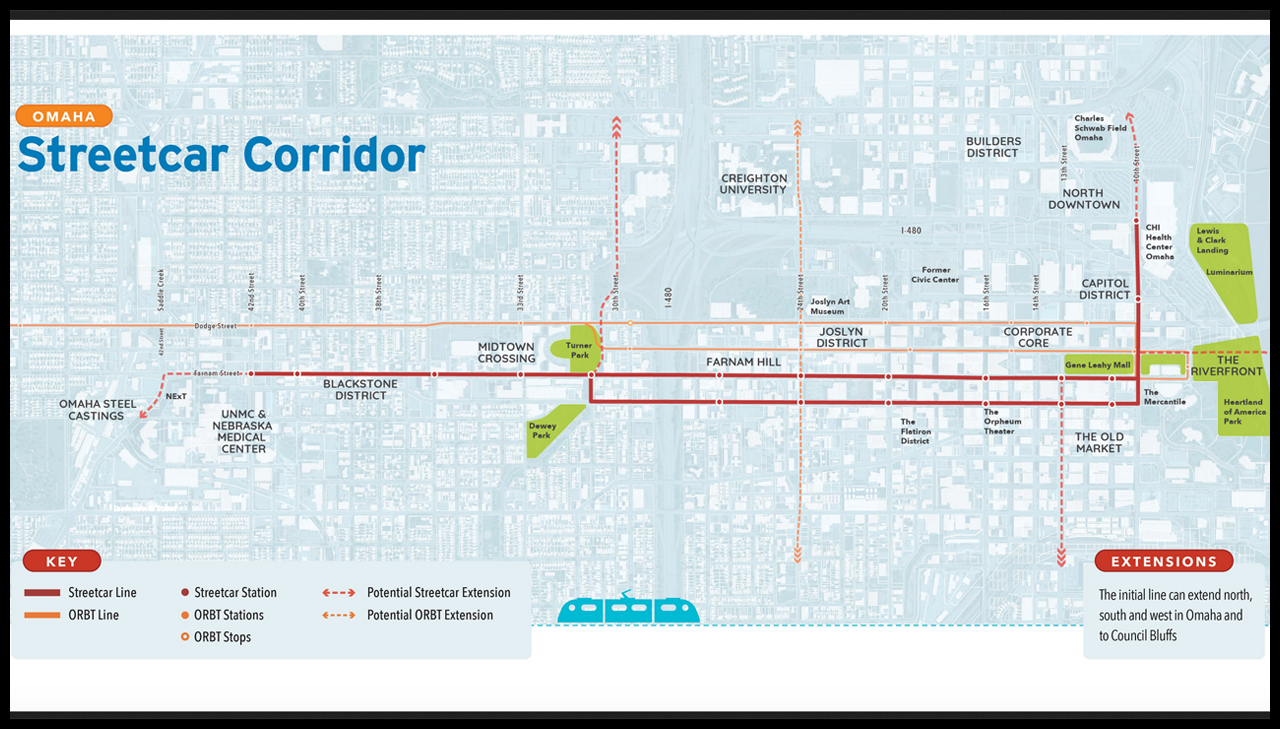

A Streetcar For Omaha Railway Age

We Buy Cars Schrier Automotive

Nebraska Vehicle Sales Tax Form Fill Out And Sign Printable Pdf Template Signnow

Nebraska Sales Tax Small Business Guide Truic

Nebraska Title Transfer Etags Vehicle Registration Title Services Driven By Technology

Nebraska Templates Format Free Download Template Net

Chevy Cars Trucks Suvs For Sale Omaha Ne

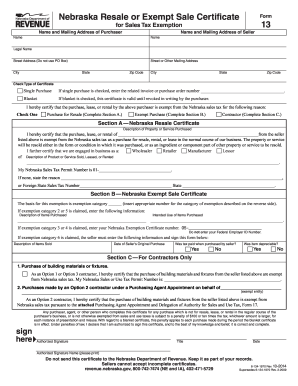

Form 13 Nebraska Fill Out And Sign Printable Pdf Template Signnow

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Buy A Used Car Near Omaha Ne Pre Owned Vehicles For Sale

The Largest City In Nebraska Omaha Loup City

Used Cars Under 10 000 For Sale In Omaha Ne Vehicle Pricing Info Edmunds

Sticker Shock How Nebraska Vehicle And Wheel Taxes Work

Used Cars For Sale In Omaha Ne Best Used Cars Near Me

Used Volvo Xc90 For Sale In Omaha Ne Cargurus

Nebraska Special Interest License Plate Mette Ne Omaha Antique Classic Car Ebay